We have found we are having more conversations with clients about timing rather than just totals. Pension contributions, bonuses and capital allowances can often be adjusted year to year. Used carefully, they can help smooth taxable profits rather than creating peaks and troughs. For businesses trading at a consistent profit level each year, a measured approach can…

Category Archives: News

From April 2029, the government plans to reduce the National Insurance advantages currently available through salary sacrifice pension contributions. Pension contributions will continue to benefit from income tax relief, but the National Insurance efficiency for both employers and employees is expected to be restricted.

There has been a climb in private equity interest in UK SMEs, particularly in established businesses that are profitable and performing consistently. In an uncertain economic climate, these businesses are often seen as a stable place to invest.

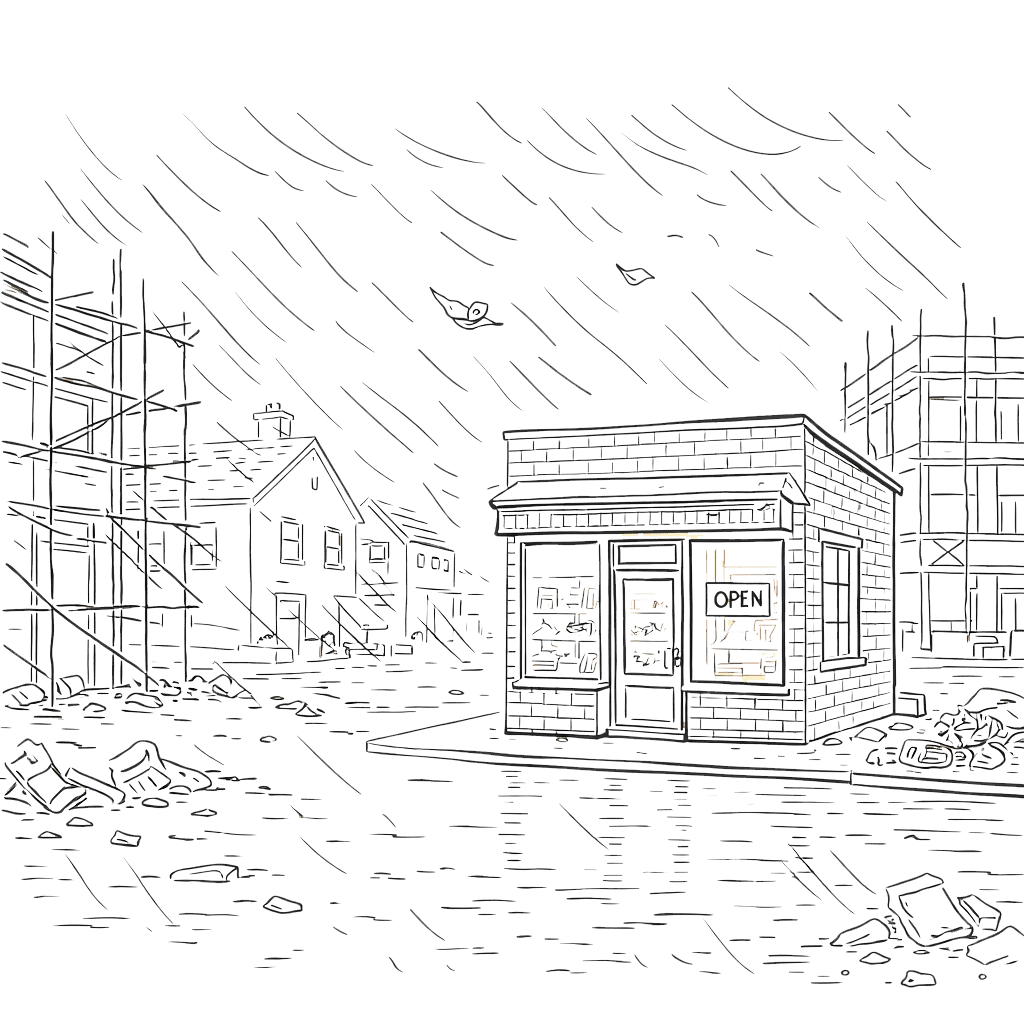

The start of 2026 we have seen rising costs are obviously a big issue for SMEs, particularly insurance and staffing costs. The businesses we see coping best are not the ones waiting for costs to fall, but those reviewing pricing, margins and cash flow, and making small adjustments now rather than having to make larger…

From April 2026, the way many landlords report their property income to HMRC will change with the introduction of Making Tax Digital for Income Tax. Instead of a single annual return, they will be required to keep digital records, submit quarterly updates using HMRC recognised software, and complete a final declaration after the end of…

The government has announced an expansion of youth apprenticeships, with plans to create up to 50,000 new places over the next three years across a range of sectors, including AI, hospitality and engineering. The proposals also include removing the 5% levy for apprentices under 25. With apprenticeship numbers having fallen significantly in recent years, this…

After last month’s Budget announcement, it is important for businesses to start planning and building upcoming changes into their budgets. From April 2026, minimum and living wage rates will rise across all age groups. Looking further ahead, from April 2029 pension contributions made via salary sacrifice will be chargeable to National Insurance above an annual…

One of the positives from last month’s Budget was the announcement of planned business rates reductions for many retail, hospitality and leisure properties from 2026/27. While these changes are still some way off, they are a welcome signal for sectors that have faced ongoing cost pressures in recent times.

Apprenticeship starts are rising across England, especially at degree level. In 2024/25, degree apprenticeships jumped 12.5% to 36,570. Among A-level students, over half now say they want to start earning straight away, and nearly four in ten believe university isn’t necessary for a successful career.

Relendex and the British Business Bank have launched a £15m scheme to back SME housebuilders, co-investing up to 25% of eligible loans. With traditional banks often reluctant to lend, the move should make finance more flexible and help get stalled projects moving.